Open banking, open finance and open API:

Everything is open, but how?

Hardly a day goes by that we are not confronted with the buzzword ‘open’ – ‘open banking’, ‘open finance’, ‘open data’, ‘open API’, or even ‘open everything’, to name just a few examples. Everything seems to be open – or to need to be open. But what exactly does ‘open’ mean in connection with banking and finance? And how should we deal with it?

Standardised interfaces

Until now, banks controlled the complete digital value chain and the client interfaces themselves. In other words, they manufactured their products independently and distributed them via their own channels. However, since the implementation of PSD2 in the EU and the Open Banking Standard in the United Kingdom at the beginning of 2018, banking infrastructure (the products) has gradually been decoupled from the front layer (the channel). The resulting flexibility – which could also be called opening up – reduces control over added value.

This opening up is driven by standardised, secure and publicly accessible open APIs. The exchange of personal financial data with clients’ approval via such interfaces is designated as ‘open banking’ or ‘open finance’ – depending on the definition of the term ‘financial data’.

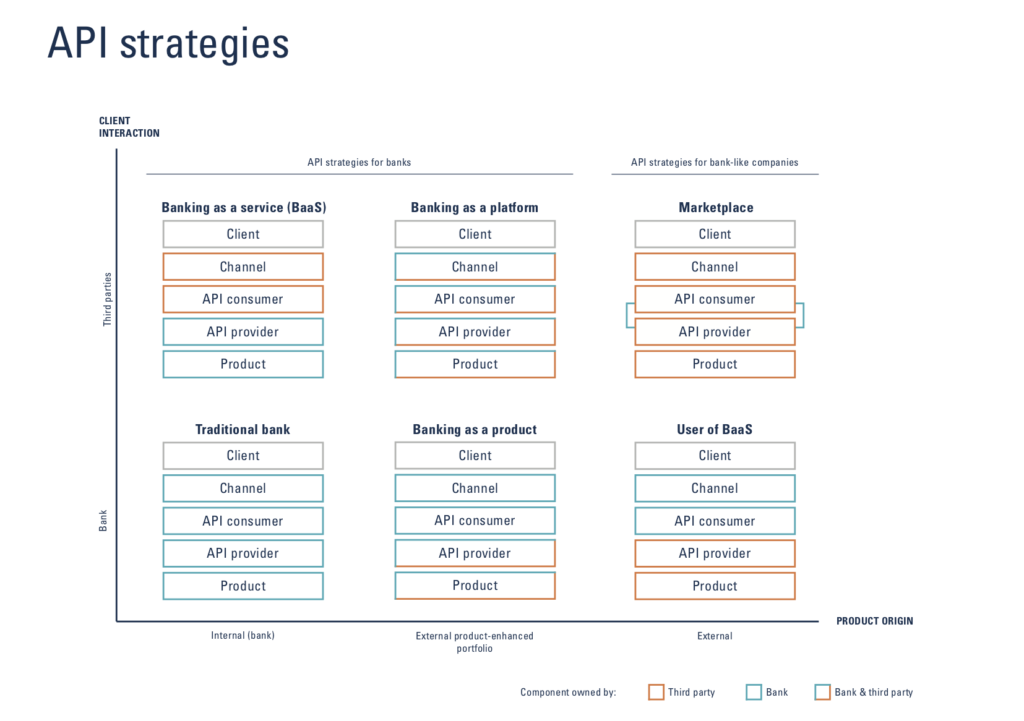

In my last article (see here), I reported on the possibilities of business model innovations that the open finance approach offers. These possibilities can now be further developed using various API strategies with the help of the model outlined above.

Opening up

It is fair to question whether being ‘open’ is even a desirable objective. On the one hand, data has become an essential success factor – the gold of tomorrow. On the other hand, many companies find that their own data is insufficient for success. It is cross-company cooperation that gives data its true value. This means that exchange is required in order to create added value for the client.

Clients are increasingly going digital. They are looking for solutions that make life easier and meet individual needs effortlessly and conveniently. For this, they are prepared to share relevant data. If an offer covers their individual needs, it will convince them. This means that more flexibility is needed in order to bring the products to the consumers.

© Finnova API strategies for the opening up of data

API strategies

How can a financial institution implement this flexibility in terms of opening up? Various API strategies are on offer for this:

- In the case of the ‘banking as a product’ strategy, the financial institution supplements its product portfolio with third-party products. The mixed product portfolio is distributed to its own clients via the existing channels. This model offers an attractive compromise with limited costs and low risks. It enables clients to benefit from a broader product range via existing digital channels, making it a kind of entry strategy.

- In the case of the ‘banking as a service’ strategy, the financial institution distributes its products via third-party channels. In doing so, it takes on the role of supplier. Clients no longer have direct interaction with the financial institution when purchasing a product. The financial institution becomes almost invisible from the clients’ perspective. This model offers the financial institution the possibility of tapping into new client groups thanks to differentiated branding.

- In the case of the ‘banking as a platform’ strategy, the financial institution additionally operates a multi-sided platform. One side of this platform produces the own and third-party channels for the clients, while the other provides the own and third-party product portfolio. This model offers the possibility of establishing a separate platform ecosystem.

- When using banking as a service, a company offers a third-party banking product via its own channels. This strategy is typically used by non-banks that want to offer a tailor-made digital banking experience to a niche market.

- In the case of the pure marketplace strategy, the company is simply an intermediary for banking products; supply meets demand. Typically, this occurs via a platform – the so-called API marketplace.

Culture of discovery

In order to implement the API strategies successfully, a culture of exploration and discovery is required. None of these strategies are calculated in a traditional business case as a result of direct monetisation. This is about searching for new value propositions and business models in an environment of great uncertainty. Brand new ideas emerge, are developed, validated and implemented to boost efficiency.

Digital banking backbone

There are prerequisites for implementing these API strategies. A digital banking backbone ensures these prerequisites are fulfilled. This backbone includes:

(1) a developer portal to make it easier to find your offers for the ecosystem;

(2) APIs based on common open standards to speed up new services;

(3) identity and consent management to secure and protect your client data;

(4) a strong API management platform to manage and control exposed APIs.

Both open banking and open finance require more flexibility and/or opening up of financial institutions. In order to meet this requirement in a new and uncertain area, both a clear strategy and the latest technical equipment are necessary.

by Sven Biellmann

Product Manager Open Finance

Finnova AG