Banks had better start gearing up:

blockchain is here to stay

Can you correctly gauge the potential of blockchain technology for the financial sector and other areas? Can you assess the opportunities offered by blockchain for breaking up existing structures and processes? Or are you only just noticing bit by bit that important gears are being set in motion? That regulation, implementation of standards and the speed at which they are adapting is having an effect? Blockchain technology is here to stay. All bankers should have realised that by now.

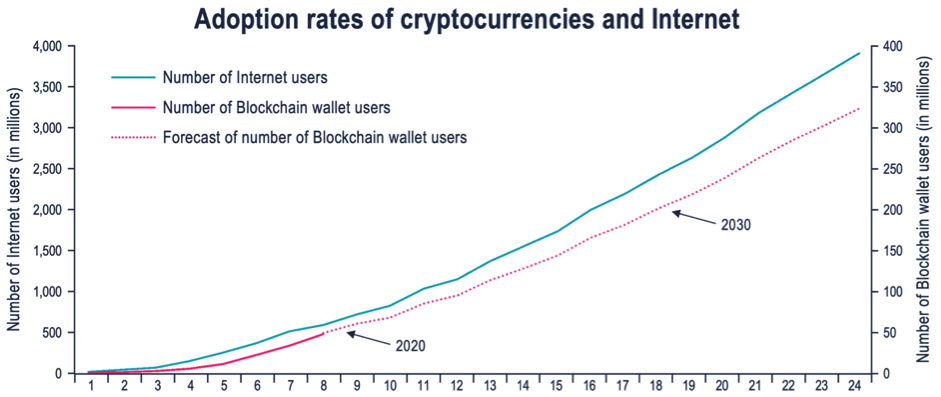

An increasing number of business models are maturing. Not only do cryptocurrencies and non-fungible tokens offer further potential for diversification of portfolios because of their loose ties to the stock market, but also new forms of financing using decentralised finance, or DeFi, will fundamentally change banking in the coming years. These hypotheses are reinforced when you compare current blockchain and crypto trends with the historic development of the internet. The increase in the number of people using the internet and using crypto currencies was very similar after the development of each technology.

Figure 1: Comparison between internet and cryptocurrency adoption rate (adopted from Deutsche Bank Research, 2019)

How can banks best position themselves in this environment, so that they are not merely keeping pace with the technology but more actively contributing to this process of change?

For positioning, it is essential that individual areas such as crypto trading, crypto custody and DeFi are not lumped together as blockchain topics. Each area requires different capabilities. The regulatory framework and technological basis can also differ. Given the increasing complexity, it is advisable for universal banks to get started with crypto trading first. They can then build on this with custody of crypto assets and then finally participation in the DeFi market.

Given limited human resources and funds, it is naturally tempting to break into this new world with a minimal level of integration. The aim is to reduce the risk as far as possible.

Pros and cons of acting as a conduit

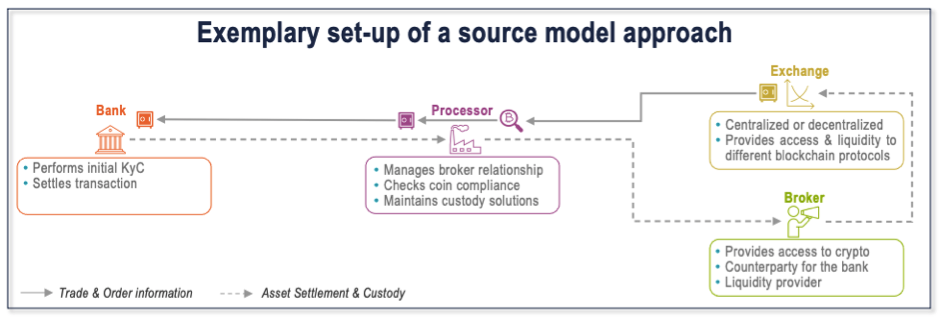

Via a third party such as a crypto trade processor, banks could offer their clients cryptocurrencies as a possible investment within one to two months. In this kind of sourced model, the bank does not acquire new skills and acts solely as a conduit between the processor and the clients.

This means that the bank just accepts the order from the client and enters it in the core banking system. The order is then forwarded directly to the processor. Overstating things slightly, this means that the bank only has to set up a new asset and they will be ready for their first crypto trade. With the exception of contractual requirements, the processor deals with everything else, for example the connection to enough types of execution venue, such as cryptocurrency exchanges and OTC desks, and the necessary prerequisites for guaranteeing best execution. Once the trade has been successfully executed, the corresponding crypto assets are delivered. In most cases, the processor operates the custody solution and ensures compliance with the adjusted anti-money laundering regulations (know your transaction). The process chain ends with reconciliation between the processor and the bank. In this step, the bank checks that no errors have arisen between initialising and finalising the process, and that the assets are held by the processor in the name of the bank.

It is undeniable that this complete outsourcing ensures short time to market. Banks can thereby make time in the short term to define their long-term crypto strategies. However, the fees paid to the broker or processor will eat up a significant amount of the bank’s client margin in the medium term – as low-cost alternatives from direct suppliers are already on the market, overpriced offers are unlikely to prevail.

Figure 2: Crypto trading lifecycle with the sourced model (Finnova, 2022)

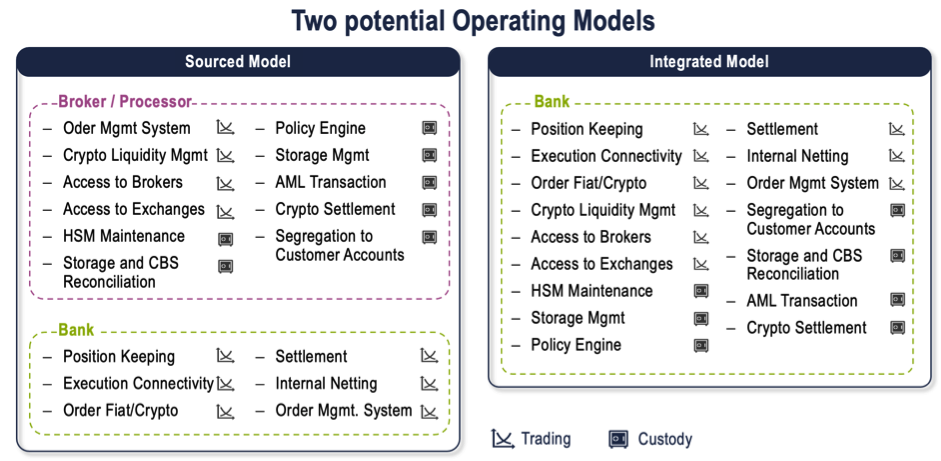

Step by step towards a digital asset strategy

Developing in-house blockchain skills is therefore an important strategic building block for benefitting from the possibilities of this technology in the long term. For example, through the integration of an order management system, know-how regarding trading of digital assets can be established. However, this requires simultaneous development of fiat liquidity management and crypto liquidity management to ensure that sufficient liquidity is always available at the desired execution venues. If all required crypto trading skills are available, then they could gradually be supplemented with crypto custody. Questions such as ‘Who is allowed to transfer how many of which coins to which counterparty?’ and ‘How are private keys managed?’ will present compliance departments with new challenges. But it is precisely these employees who will ensure access to the core business of the future with the integrated model.

Perhaps in the short to medium term, a portfolio management system will be able to create portfolio overviews of traditional and crypto assets. In the long term, however, the trend is unstoppably going in the direction of tokenised securities, which can be managed more cost-effectively in cutting-edge key management systems than classic securities by traditional custodians.

Figure 3: Capability allocation based on different operating models (Finnova, 2021)

Thinking outside the box

The moment of truth will only come with the growing maturity of decentralised finance. This will fundamentally change the traditional business and revenue streams – payments, investments and loans – of all banks as, for example, processing loans and securities will be commodified by the blockchain but trusted gatekeepers who advise and lead clients into this new world will be much needed. It is already clear that existing know-how and skills that need to be developed for early integration of crypto trading will be valuable, time-saving and – ultimately – decisive for market success. If crypto trading is first outsourced and only later brought in-house, there is a threat of delays and huge investments. In this case, crypto trading is more than likely to be outsourced again due to the missed opportunity to build up resources.

The consequences of such outsourcing are currently unforeseeable. However, as blockchain and cryptocurrencies are here to stay, banks should not only look at this topic from a simple tactical product perspective but discuss the potential strategically with a clear transformation plan.

by Dr Ante Plazibat

Head Emerging Business

Finnova AG

and Sascha Hofer

Business Analyst

Finnova AG