KYC: it’s worth knowing your customers

Which touchpoints do clients want for interacting with banks? Regardless of whether communication is taking place in person, by letter or through digital channels, digitalisation is a key to success for the banking industry.

Nowadays, banks and businesses possess a wealth of information about both existing clients and potential new clients. This information exists in form of data – the big challenge for the banks is to use it in a targeted and efficient manner, to have the right tools in place and to train and educate employees accordingly. Handling data in the right way can be a key differentiator between competitors, which becomes even more important in the age of standardised back-office processes. There is also the matter of complying with regulatory requirements. As a consequence, new key roles will have to be created within organisations. Clients expect smooth, seamless processing of their banking activities via their preferred channels. The wide range of available channels – which can vary depending on the target group and generation – are a further challenge for both IT systems and banks.

A human-centric approach

Despite all the technologies and developments, human beings are and remain the focus of companies, both as employees representing a decisive part of the company, and as clients generating the company’s financial success.

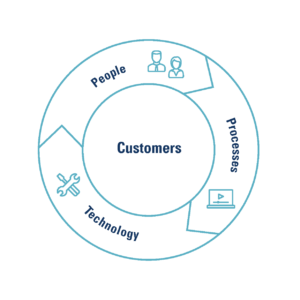

Clients want to be served with the perfect client experience. But what does this look like? Every person is different, and individual expectations need to be met, which adds another layer of complexity for companies. The client experience should be discreet, efficient and targeted, taking place via the right channel at the right time. From a company’s perspective, this means putting clients at the centre of the interaction between people, technology and processes. The extended possibilities for clients to obtain information themselves, and new technologies are additional requirements for banks.

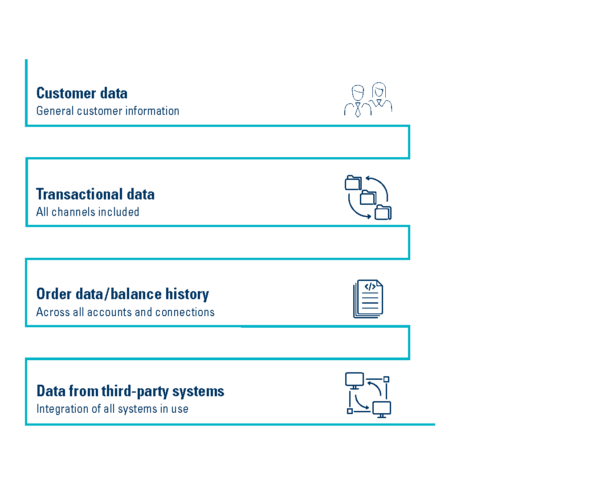

Data is the foundation for this. Banks possess a whole host of client-specific data from a variety of sources.

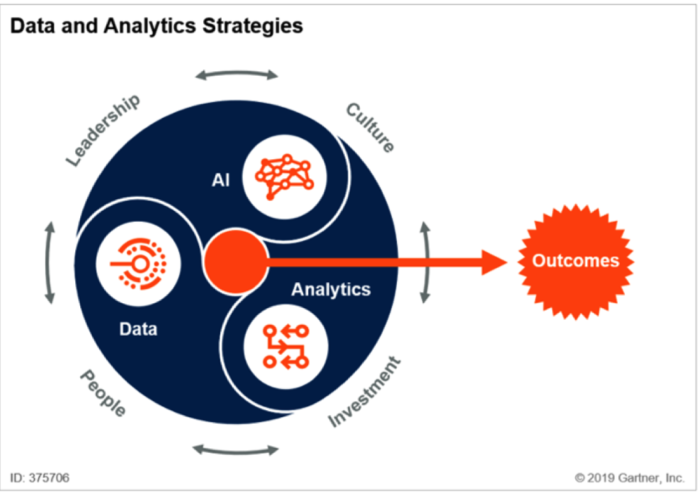

What can companies do with all this data, and how can they use it? When data is used appropriately and is of a suitable quality, it can be applied with AI and analytics in a company geared towards data strategy to achieve specific, value-oriented outcomes. Gartner has developed a concept for this.

These outcomes with clients at the centre could be:

- Prioritisation of pending tasks for client advisors

- Timely identification of risks and opportunities

- Real-time monitoring

- Compliance: KYC and fraud detection

- Determining the next best action

- Early determination of risk of client attrition

- Identification and determination of opportunities for cross- and upselling

- Business activity monitoring

- Digital fingerprint analyses

- Voice analyses

- Creation of a uniform and consistent 360° client view

Naturally, there are associated challenges that banks need to overcome when handling data, such as:

- Data quality

- Data storage

- Data consistency

- Data deletion

- Management of complexity

‘Is data the new oil?’, an IFZ banking study, shows that the majority of banks (69%) still use the core banking system for processing client master data, although 56% already have a specific CRM system in place. Many still work with Excel spreadsheets, which may delay possible implementation – and capacity – of AI.

Chief Data Officer – The new strong role at banks?

The processing of the huge amount of information in the form of data from all the different sources in a targeted and efficient manner is a challenge and requires a high level of responsibility. Furthermore, companies need to have the required tools and systems available, and employees need to be trained accordingly. The management of – and responsibility for – this complex mix of requirements will inevitably increase in importance within companies. As a result, the role of Chief Data Officer seems to be becoming increasingly important. Handling data in the right way can be a key differentiator between competitors, which becomes even more important in the age of standardised back-office processes. There is also the matter of complying with regulatory requirements. This results in data teams being of increasing importance within companies.

The IFZ study also showed that around 51% of the banks that responded still do not see the management of client data as being of strategic importance. This indicates that data teams and related leadership roles are still not top priority. It will take some time for this to become established within corporate cultures.

By Dr Martin Widmer

Head of PM Data Analytics & Compliance

Finnova AG