Variety instead of monotony

Clevercircles, the digital investment management platform of Bank CIC, is the first multi-advisor in the world and combines the intelligence of human beings with the efficiency of machines. This brings the idea of community into the world of investment.

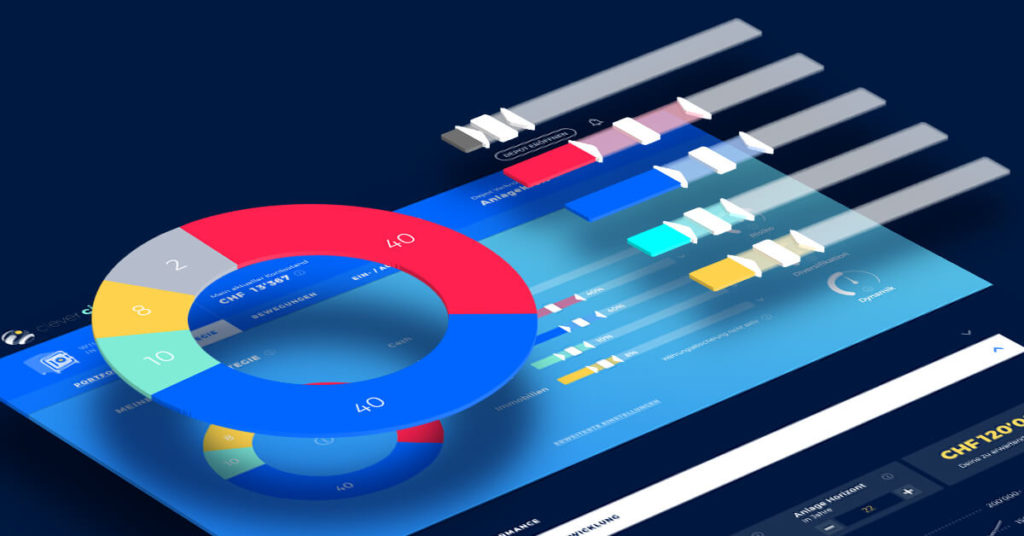

Together, Bank CIC and ti&m have developed a new digital investment management platform which differs markedly from existing current services. The platform, which entered the market in spring of 2018 under the name clevercircles, has, for the first time ever, linked the advantages of roboadvisors with the potential for the client to strategically manage their asset allocation themselves. In the process, the client will be able to check their opinions with a chosen trusted third party or with the crowd.

With regular participation in decision making, clevercircles provides new approaches and not only the hard facts, such as the low costs and easy access, are convincing, but also the soft factors. The focus is on the person. Before people make important decisions they normally verify their opinion with chosen trusted third parties. This applies equally to experts and inexperienced investors. Community spirit in the investment environment. In the age of social media, this process is increasingly happening online. Communities are emerging that are often larger and more diverse than just purely personal contact. clevercircles has recognized this and channelled this community spirit into the world of investment.

Participation is key

For this reason, the new platform places the focus on client participation as an important requirement. clevercircles allows clients to regularly adjust their investment strategy at a tactical asset allocation level using simple and intuitive questions. In doing this, clevercircles has bridged the gap between the automated investment management systems and complicated trading platforms in the digital range offered by banks.

Much more than a robo-advisor

On clevercircles, the client specifies their individual investment strategy. The client can determine the investment ratio of 16 underlying asset classes which can be specified and completely customised to suit their individual requirements. Each one corresponds to an ETF or an index fund respectively from clevercircles’ investment universe. Additionally, the client sets strategic ranges for each investment class, within which the weightings can be regularly adjusted. This means that the client has a great deal of flexibility and they also have the option to specify asymmetrical ranges.

A small detail that makes a big difference

Every two months a restructuring cycle is carried out. At the core of this lies co-operation. Every participant can submit their forecasts for the most important markets using a simple questionnaire. The questions are worded intuitively and they can be answered without any previous knowledge. There are no technical financial terms used in the additional accompanying texts. This makes a subtle but important difference to the platform in terms of its user-friendliness.

Wisdom of the crowd

The clevercircles client can compare their own opinion with that of their own “circle”, as is usually the case with families, friends and especially in the case of expert investors. You can imagine the circle as a self-compiled “investment committee” with the one difference being that the account holder can verify his/her views with those of the people that they trust the most, but in the end, makes their own decisions regarding effective restructure.

Opportunities for independent investment Managers

clevercircles is client-compatible and can be used by other investment managers, banks and insurance companies using the white label model. It is a quick and cost-effective method of providing a multi-advisor. The existing clevercircles community can be shared with your own community. This leads to an increase in collective intelligence for all participants which creates a real win-win situation. The partner institute can draw on the existing community and the existing community also benefits from the new opinions on the platform. The client benefits the most from this, with a high level of diversity and a stronger foundation in the collective vote. |

Three questions to

Sebastian Comment

Managing Director

Clevercircles

How important are investment experts to Clevercircles users?

« Professional market assessments are a customer need. We are the only investment platform that allows you to combine different professional opinions at the investment strategy level. Accordingly, we try not only to enlarge the circle of investment experts who participate in our platform, but also to be able to offer different philosophies, be it classic portfolio managers, financial journalists or modern approaches such as Behavioral Finance. The expert opinions often serve as an aid in deciding whether one’s own portfolio should be reallocated. For many clients, this approach to tactical asset allocation is new and therefore independent and professional advice is in great demand. »

Does Switzerland need another Robo Advisor?

Robo-Advisor is only a term, only a fuzzy one. The essential question is what are the customer needs and are these covered. We have conducted a wide-ranging survey on this issue. Not surprisingly, low costs and simplicity are imperative, but today you can no longer differentiate yourself with them. What is expensive and complicated will not be accepted. The most frequently mentioned desire after that is regular involvement. Two out of three Swiss respondents consider it (very) important to be able to make regular decisions about their portfolio composition. This is where we come in and present not the 24th Robo Advisor, but the first Multi Advisor!

Gamifaction in banking is so far rather a marginal phenomenon in Switzerland, why and how do you rely on it?

Clevercircles stands for efficient and focused investment that is also fun. For example, we use gamification elements to combine these goals by translating a new dimension of transparency in a playful way. In concrete terms, we compare the success rate of market forecasts for each participant and each circle. In terms of figures, this is a somewhat complex story, which is why we translate it into simple experience points. These experience points are in the basis a sharp measure for the quality of market forecasts, we use them for rankings and trophies etc.. This means that every clevercircles participant, even if he is not familiar with investment formulas, has a simple orientation and can quickly assess whose forecasts are good.